Harbour Collection Services inside DeKalb State, Georgia

The guy also failed to recognize how tough it could be to save within the terms of the fresh contract, as the the guy did not understand how much work the house perform you prefer. There is absolutely no demands you to definitely a house inspector look at the household prior to a binding agreement-for-action contract is actually signed. When Harbour informed him he must rating insurance, he states, the insurance coverage business come sending him complications with the house that he don’t have any idea stayed-you to definitely document he exhibited myself, such, told your that their rake board, that is a piece of wood near his eaves, is indicating break down.

And you may 2nd, Satter said, each one of these businesses are aggressively centering on neighborhoods where owners battle that have credit because of prior predatory lending means, like those that powered this new subprime-home loan drama

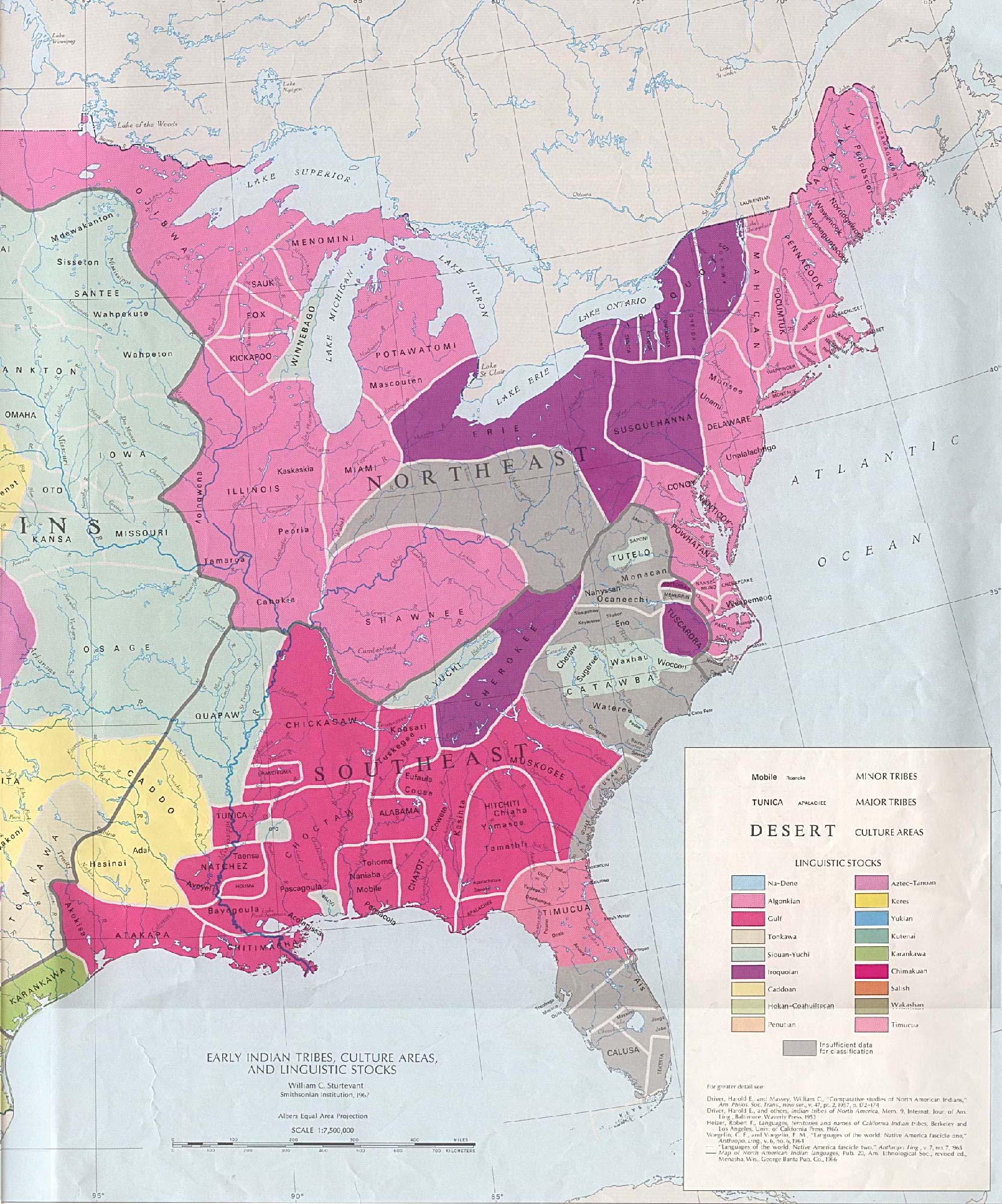

It chart, as part of the Courtroom Help complaint, shows the new racial constitution of the areas in which Harbour functions was based in one Atlanta county. (Atlanta Court Services Neighborhood)

There is nothing naturally incorrect with bargain-for-deed agreements, claims Satter, whoever father, Mark Satter, helped plan out Chi town citizens from the practice on 1950s. Will still be easy for manufacturers who are not financial institutions to invest in services within the a good means, she told you. A san francisco begin-right up named Divvy, for-instance, is actually comparison a rent-to-very own design within the Kansas and you will Georgia that delivers do-feel people particular collateral home, no matter if they default to the repayments. But there have been two explanations these types of https://paydayloancolorado.net/meridian/ bargain-for-deed plans seem such as for example unjust, Satter told you. Earliest, the newest property a large number of these businesses get can be found in dreadful condition-many got vacant for decades ahead of are bought, in place of the latest homes sold to possess price getting deed on the 1950s, which frequently is abandoned of the light property owners fleeing so you can the fresh new suburbs. Fixer-uppers make it difficult to possess create-end up being customers in order to meet the terms of its contracts, while the houses you want such really works.

The fresh new financing uck, making it possible for finance companies supply subprime fund or any other borrowing products so you’re able to people who if not may not have entry to home loans

In a few indicates, the fresh new intensity of package-for-action characteristics during the African american neighborhoods is actually a systematic outgrowth away from what happened into the housing boom-and-bust. Have a tendency to, these things charged exorbitantly large interest rates and you may targeted African People in the us. One analysis learned that between 2004 and you will 2007, African People in america was indeed 105 per cent apt to be than light buyers so you can have large-costs mortgage loans to have domestic requests, even though dealing with getting credit score and other risk facts. Whenever most of these anyone lost their houses, the banks got all of them over. Individuals who don’t sell within market-have a tendency to those in mainly Ebony neighborhoods in which individuals with funding don’t want to wade-wound-up on profile regarding Federal national mortgage association, which in fact had insured the loan financing. (Speaking of very-titled REO, otherwise real-estate had land, due to the fact lender had them after failing to sell all of them on a foreclosures public auction.) Federal national mortgage association then provided these types of house right up in the reasonable prices to help you dealers who desired to make them, like Harbour.

But Court Assistance alleges you to Harbour’s visibility for the Atlanta’s Ebony communities is over happenstance. From the deciding to merely pick land away from Federal national mortgage association, brand new lawsuit claims, Harbour wound up with land inside elements you to knowledgeable the greatest amount of foreclosure, which are the exact same groups directed from the subprime-mortgage lenders-groups from color. Possibly the Federal national mortgage association land Harbour ordered have been when you look at the distinctly African Western neighborhoods, the newest lawsuit alleges. The average racial composition of your census tracts during the Fulton and DeKalb areas, where Harbour bought, is actually more 86 per cent Dark colored. Almost every other people in the same areas one to purchased Federal national mortgage association REO qualities bought in census tracts that were 71 % Ebony, the new lawsuit states. Harbour along with focused the products it makes at African Us americans, the fresh new lawsuit contends. They did not sector the price-for-deed plans when you look at the click, to the radio, otherwise on tv inside the Atlanta, brand new match says. Alternatively, Harbour set-up cues when you look at the Dark colored areas and you will provided recommendation incentives, a habit which, the fresh suit alleges, intended it was mostly African People in the us just who observed Harbour’s provide.