There need come alterations in just how credit scores are computed, that can after that increase mediocre fico scores

Such as for instance, paid collections under $five-hundred had been taken from consumers’ credit history and tend to be zero offered claimed. Alter so you’re able to just how medical loans affects your credit rating also have improved consumers’ borrowing from the bank records.

How was credit ratings put?

Credit scores are computed having fun with information about your own borrowing, such as your borrowing from the bank application proportion, the amount and you can sort of accounts you have got unlock, plus repayment history. All of that information is pulled from the credit file, with reveal credit records.

Everyone has fico scores considering study gathered from the three significant credit bureaus: Experian, Equifax, and you may TransUnion. There have been two credit rating algorithms, labeled as FICO and VantageScore. Whilst each one uses a slightly more calculation, your own scores is to fundamentally end up being in this a comparable variety.

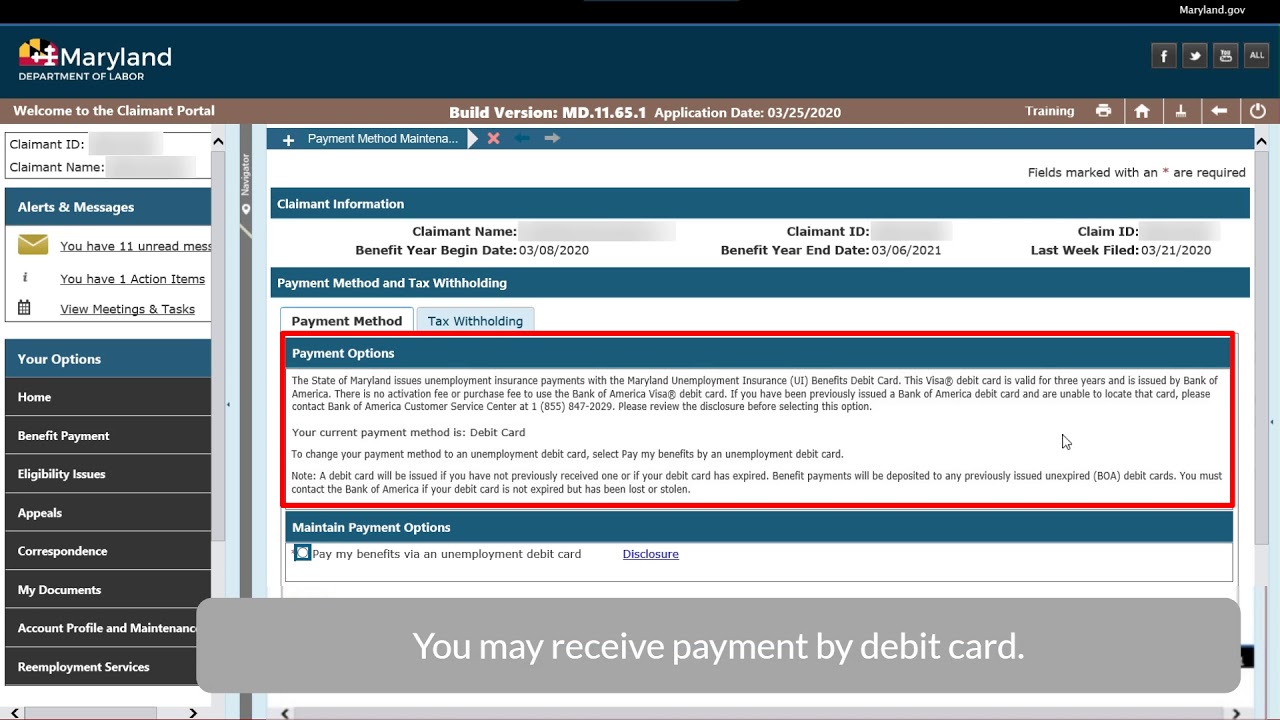

Fico scores are acclimatized to determine approval to own borrowing products eg mortgages, credit cards, and private funds. Interest levels and financing words will be reviewed based on your own credit history and you will payment record. Fico scores are actually used in apartment renting, auto insurance, and you can, sometimes, a job.

Monitoring such results is crucial when you need to build borrowing from the bank. Cannot feel expenses to access your credit score. You can always accessibility their results 100% free through your financial otherwise financial institution. You can also availability your credit rating online out-of sites for example Credit Karma.

It is better to test your credit report frequently, as well. You can get around three yearly profile, you to definitely away from for every credit bureau, which you’ll accessibility as a consequence of AnnualCreditReport. It isn’t unusual having a report to help you consist of a blunder affecting your score, but it’s your decision to locate these mistake. In the event you find one, you might conflict your credit score on department.

loan places Glastonbury Center

Circumstances impacting an average credit score

This is basically the most important factor and contains the largest perception on your own score. A positive percentage history is the greatest; even one to later otherwise overlooked percentage can be adversely effect the rating. Make sure to generate the payments on time.

This is actually the number of their available credit that you will be having fun with. Keepin constantly your available borrowing large as well as your expense low can help your own get.

That it refers to your own various other mortgage levels, such as playing cards, mortgage loans, student education loans, and you will car and truck loans. To be able to deal with a combination of various other borrowing from the bank levels can positively perception your credit score.

The length of time you got borrowing also can perception your own score. The latest expanded you have got positive credit rating the higher it is for the get.

How to strengthen your credit history

Your own credit ratings play a big part on your own financial freedom. It data to the everything from being qualified to own home financing or borrowing card on price you only pay on your own car insurance. Poor credit tends to make everything tough. However, you’ll find always things you can do to evolve your own credit history, including:

- While making your entire financing, charge card, or other monthly premiums timely is important

- Pay costs and you may render delinquent account newest

- Pay your own bank card balance entirely monthly

- Avoid applying for brand new borrowing from the bank if you don’t actually need they

- Continue empty credit accounts discover

Without having one credit rating, it becomes difficult to obtain, so it is tough to generate a credit rating. For this reason some credit card companies give certain shielded handmade cards for all those to make use of briefly to create credit out-of scratch. You can also come across our picks to discover the best beginning borrowing cards here.