3. Va finance limiting otherwise encouraging owner to expend particular closure will set you back

There’s no personal financial insurance rates (PMI) which have Virtual assistant finance. But Va funds perform have a compulsory financial support commission that happens right to the new Institution of Experts Factors. Borrowers that have an assistance-connected handicap is actually exempt out of spending which commission. It will help save money on the monthly premiums and you may initial will cost you. This is going to make a sacramento or Placer Condition household less costly.

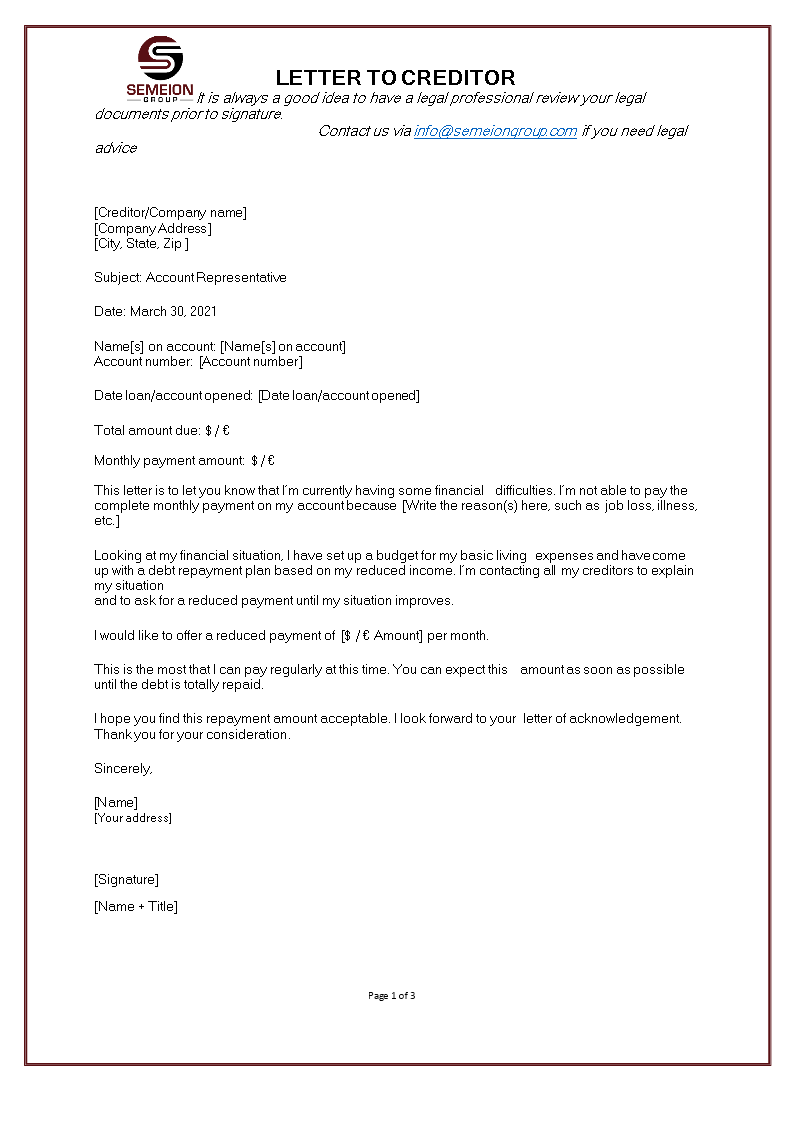

Inside the 2022 the latest Va funding percentage cost is actually because followed:

Settlement costs are included in taking home financing. The newest Virtual assistant indeed constraints just what fees and can cost you veterans pays at the time of closure. This is simply not always a good question. Often it is complicate a bona fide property transaction. Brand new seasoned family consumer may specific closing costs advice.

Our home consumer/s is also query manufacturers to pay all of their loan-associated settlement costs or more to cuatro % of get rate to have things like prepaid service fees and insurance policies, selections and you may judgments. Do you believe this new seller’s would like to do that? Do you believe certain seller’s doesn’t undertake a deal in the event the its revealed that it will become a beneficial Va financing consumer? I have had numerous deals produced more difficult to shut just like the out-of hopes of the latest seasoned customer thinking they will certainly immediately score such seller’s concessions. Property ‘s the art out-of transactions. The new experienced visitors having good Va financing will add worth to the transaction or be an issue. Its doing the real estate agents to help you discuss an effective an effective profit-profit package.

cuatro. The fresh Virtual assistant financing might have looser credit standards or otherwise not.

To know a number of the almost every other positives you must know just what an excellent Virtual assistant Financing is actually. A great Virtual assistant financing try a mortgage awarded of the individual loan providers and partially backed, or protected, because of the Department from Veterans Activities. So it is clear, the Company of Veterans Affairs cannot generate good Va Financing. This new Va Mortgage are a hope into the financial to have part of the mortgage worthy of. That’s right. Perhaps not the whole mortgage but a percentage of mortgage worth.

Lenders will however check your fico scores, income peak, or any other what to choose recognition, in addition to interest you’ll receive therefore, the individuals meet financial criteria. Similarly the lender seems they’re able to enjoys loose mortgage criteria as part of the financing try protected. However, additionally it is not easy and expensive to foreclose towards a home loan. How the lender stability these issues often determine how the next couples positives enjoy aside. And why you should here are some one or more lender for good Virtual assistant mortgage.

5. Certain Va loan lenders could work with high DTI rates so you can build that loan.

Virtual assistant loan providers essentially use the level of 41 percent of your own terrible month-to-month money toward major bills, for example a mortgage https://paydayloancolorado.net/avondale/ commission otherwise college loans. many loan providers require way more Virtual assistant finance towards the instructions and you can undertake a top DTI ratio but still generate a beneficial Va home loan. Specific loan providers may go around 55 per cent or higher situated in your power to pay-off the borrowed funds based on earnings or any other credit circumstances. This will create easier for some customers to maximise its family to find power. New month-to-month mortgage repayment is influenced by the eye rates at the the amount of time of your financing. Virtual assistant finance are notable for the aggressive cost.

six. Certain Virtual assistant loan companies can work that have foreclosures and you will bankruptcy proceeding greatest.

Specific Va loan lenders work on problem of foreclosures and you can bankruptcy. Others doesn’t. You’ll safe an excellent Virtual assistant financial merely a couple age taken out of a foreclosures, small marketing otherwise bankruptcy. In some cases, veterans whom apply for Section 13 bankruptcy proceeding shelter is going to be eligible merely a year taken off the submitting go out. Even when the experienced has actually a foreclosure to your a great Va-backed mortgage, he could be entitled to a different.