Refinancing involves replacement your current financing having one that boasts greatest terms, such lower monthly obligations

LendingTree Application Process

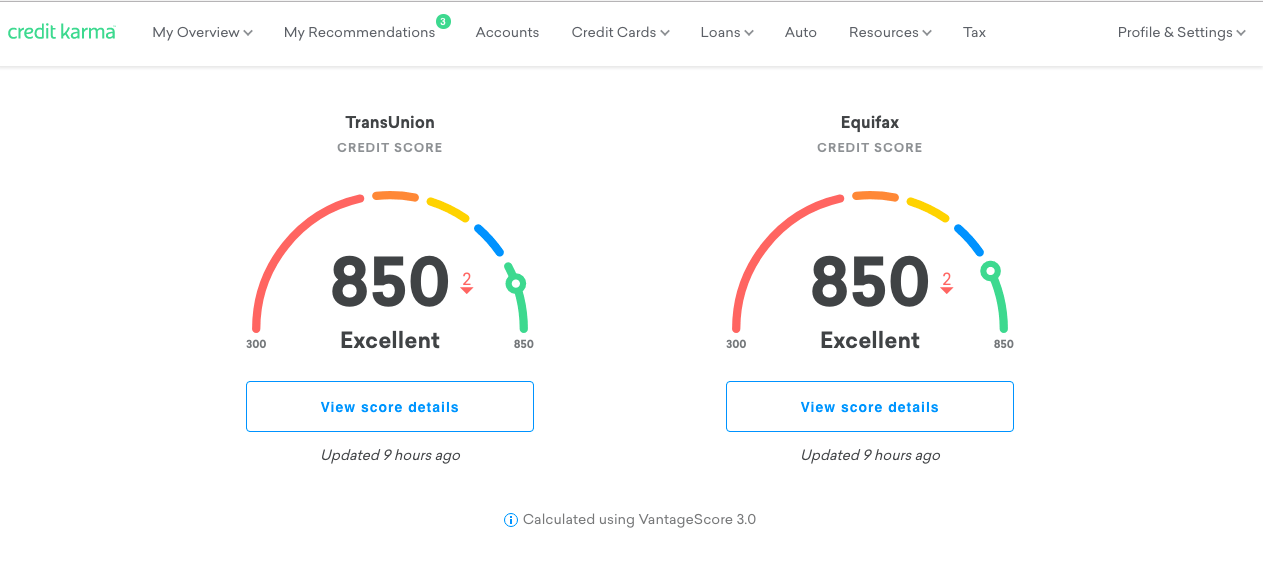

- Keeping an eye on your three-little finger credit rating is crucial on the capability to borrow funds and you can score a good interest. A lowered interest rate is more likely to be considering in the event that you have got increased credit score as the loan providers assume your pose https://simplycashadvance.net/personal-loans-ut/ a lesser risk as a borrower. Find out your credit rating now.

- Rating prequalified and look around: APRs are different generally out-of lender so you’re able to financial, therefore it is best if you shop around. Owing to prequalification, you will see financing has the benefit of having a smooth credit assessment. Along these lines, you can see whether you qualify for the mortgage. not, prequalification doesn’t mean that formal application will be approved.

- Compare financing offers: When you have prequalified which includes lenders, examine the loan words and charge generally speaking, both interest rate and you can fees try reflected on yearly payment price. When you decide and therefore bank to apply having, you can begin the procedure.

- Assemble support data: The bank can get inquire about additional data whenever making an application for the borrowed funds. Get ready for the application form by get together data files including evidence of money (like salary stubs), proof of obligations (particularly financial statements), and bank account comments.

- Formally incorporate: Their lender preference often today found a proper application from your. A difficult credit check often is required when applying for a good consumer loan online. Proceed with the lender’s advice and you can fill out people data which they consult.

- Wait for that loan choice: Shortly after a loan provider receives the job and you may pulls your credit report, they often make up your mind in a hurry. Usually, you will discover inside days. With regards to the bank, it requires time and energy to get the currency. Some lenders enjoys same-date financial support down loaded towards the savings account.

LendingTree Refinancing

On the other hand to decreasing the identity of one’s loan, refinancing can also be eliminate private home loan insurance otherwise allow you to switch in order to a predetermined-speed loan.

Refinancing mortgage for the 5 Actions

For those who refinance the financial, you go through a comparable process just like the when you got from the mortgage. After the are the five tips to have refinancing mortgage:

- Opt for Your Re-finance Objective

Having a mortgage refinance, you need to alter your financial predicament. Loan providers refer to intangible online masters since intangible websites advantages.

- Look at the Credit history And you can Funds

Alert the credit service written down if you learn mistakes to the your own credit reports. You happen to be very carefully vetted of the loan providers, including your earnings, employment records, costs, property, and you can credit ratings.

As a whole, you need a good 580 in order to 620 credit score in order to refinance the financial. More often than not, cannot exceed 43% of your disgusting month-to-month earnings regarding the obligations-to-earnings ratio (DTI).

- Figure out how Far Security You really have

A higher equity level will generally bring about a reduced home loan price. Paying their dominant loan amount increases the value of their domestic throughout the years. You could potentially subtract the present day home loan balance on latest well worth in your home (and every other money).

You really need to get good re-finance with 3 to 5 lenders in this two weeks (and generally in this forty five days, dependent on which credit rating design for each and every bank spends). During this time period, numerous credit concerns will on your credit history overall borrowing query and won’t apply at your credit rating adversely.

Immediately, secure your mortgage price. You age speed because the last night, and you may prices transform day-after-day. When you protected a speed sooner rather than later, you simply will not need to bother about they changing.