Death Spiral Debt: What it is, How it Works, Why it’s Created

If a company cannot pay its bills on time or is consistently late in paying its bills, it is a sign that the company is experiencing financial difficulties. This can lead to losing credibility with suppliers, making it challenging to secure new business. Big companies like Sears, death spiral accounting United Technologies, General Motors and General Electric have slowed down. While their services are still needed, their value is no longer a luxury but a commodity. There is a TV in every household—stats show the majority of U.S. households have at least two televisions.

- You can bet the latter two expect a far greater ROI from their purchases—the markets do, just look at the market prices the day the news broke.

- By taking proactive measures, companies can prevent a death spiral from occurring and position themselves for long-term success.

- However, conversion results in a fixed value paid in shares, and the bondholder seems to be in a position of shorting the stock (short selling the stock).

- In general, convertible debt yields interest or dividends but also can be converted to common stock shares.

Customers

One key benefit of pursuing this latter pricing mechanism is that the price of low sales is separated from the cost of production. By doing so, the overhead now has to be spread over the four remaining products. However, it’s now receiving 25% of the total overhead costs, which might also make it look unprofitable. If your client decides to cut the cord and end Product D’s life, it has entered a death spiral as the increasing burden continually impacts the other product lines. Sometimes, such cases of death spiral financing lead to drastic falls in stock prices, reducing its market capitalization, and resulting in competitors taking over the market.

Key Management Personnel: Roles, Responsibilities, and Impact

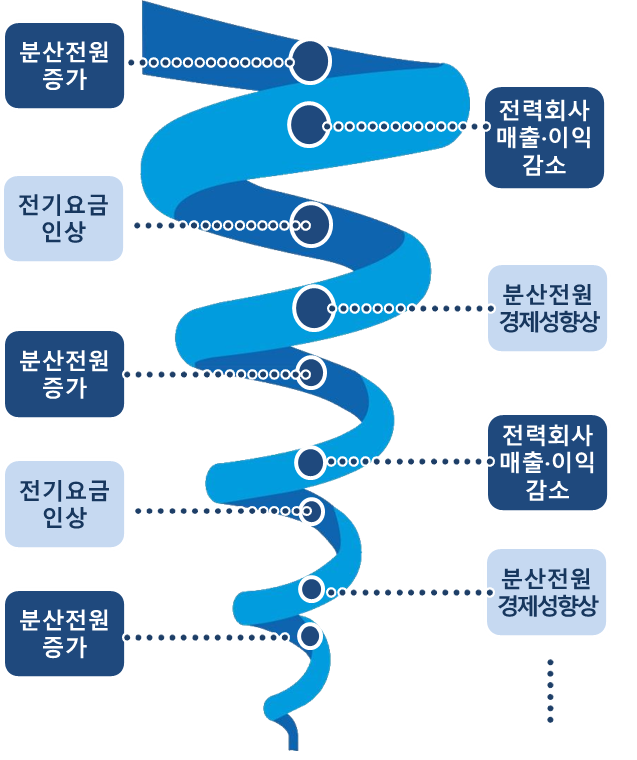

Assume that a company manufactures a wide variety of products that require multiple, complicated processes involving expensive equipment. It also manufacturers Products X & Y, which are much higher volume products using a simple process involving inexpensive machines. If the company allocates its fixed manufacturing overhead costs to products based on volume (such as production machine hours), Products X & Y will appear to have high overhead costs. With the Products X & Y no longer being manufactured, the company’s manufacturing production machine hours will decrease significantly. If management again reacts to the new, higher, allocated costs by seeking price increases and loses sales, the company’s manufacturing volume will decrease further.

Cash Flow Problems

With fewer unit sales and no reduction in overhead costs, the remaining products will be assigned greater per unit overhead costs. If selling prices are increased to cover these still higher unit costs, there could be a further decline in sales. Investing in technology and automation can also play a significant role in mitigating the death spiral. Advanced analytics and machine learning tools can provide deeper insights into cost structures, customer behavior, and market trends.

As revenue continues to decline, the owner decides to cut back on the store’s inventory to reduce costs. However, this leads to decreased foot traffic and sales, further exacerbating the problem. To make matters worse, the owner cannot negotiate lower rent payments with the landlord, making fixed costs a significant burden on the business. A third reason companies enter into a death spiral is a lack of financial discipline.

Support & Services

Airlines have high fixed costs, such as fuel and maintenance expenses, making them vulnerable to market fluctuations. The pandemic has significantly impacted the airline industry, causing many businesses to declare bankruptcy. Manufacturing businesses require significant capital investments and often have high fixed costs. If a manufacturing business experiences a decline in demand, it can quickly become unprofitable.

Therefore, it’s essential for companies to carefully manage their costs and revenue streams to prevent a death spiral from occurring, regardless of whether their demand is increasing or decreasing. A company’s leadership team should prioritize revenue growth to ensure it generates enough income to cover its expenses. This can be achieved through expanding into new markets, introducing new products or services, or increasing sales efforts. The death spiral in business often starts with a problem or issue that affects the company’s operations, such as declining sales or increasing costs. If these issues are not addressed quickly and effectively, they can spiral out of control and create a negative feedback loop, where one problem leads to another, and the company struggles to keep up.

Financial management is a critical aspect of any business, and one of the most perilous pitfalls it can encounter is death spiral accounting. This phenomenon can lead to devastating financial consequences if not properly managed. Each additional conversion will cause more price drops as the supply of shares increases, causing the process to repeat itself as the stock’s price spirals downward. A company that issues this type of convertible bond is probably desperate for cash to stay afloat. Even employees not directly affected by job loss or reduced benefits may still be impacted by a death spiral. A sense of uncertainty and instability within the company can make it difficult for employees to feel satisfied with their jobs, leading to increased turnover and difficulty attracting new talent.

Companies must know the warning signs of a death spiral and take action early to avoid it. With careful planning and focusing on financial stability, companies can thrive and avoid the pitfalls of a death spiral. A budget is essential for managing your finances and avoiding a death spiral. A budget helps you to plan your expenses and allocate your resources effectively.