Helpful information about how to Download and check Their HDFC Domestic Mortgage Declaration – Step-by-Step Process

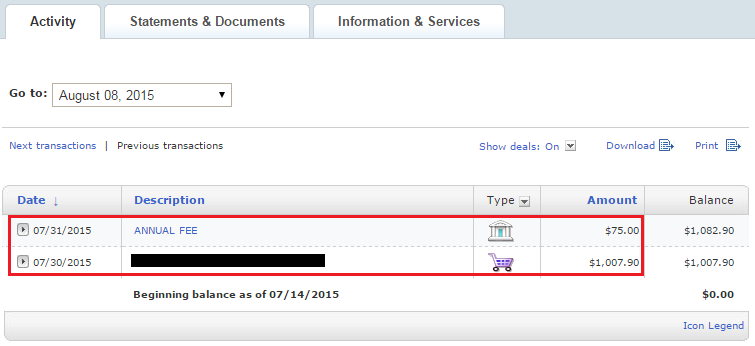

Opening and you may looking at your HDFC Mortgage report online is a great straightforward procedure designed to bring convenience and show. To have HDFC Bank customers, which studio lets a straightforward writeup on mortgage statements, ensuring he could be updated on the mortgage standing, also dominating and interest section, and can manage the finances most readily useful. Its like utilized for pinpointing any discrepancies early and you will finding out how for every single payment influences the loan harmony.

Moreover, downloading the loan statement on the internet through the HDFC netbanking webpage are critical for consumers seeking to allege taxation write-offs. With the mortgage declaration in hand, customers can easily identify eligible taxation write-offs below certain sections of income tax guidelines, so it is an important file getting thought and you can submitting income taxes. The process requires the user’s ID to own a safe log in, making sure the new owner’s economic recommendations stays secure.

Skills Their HDFC Financial Statement On line

Lenders also have the mandatory let necessary to improve dream of having your house on the an accessible reality. Once efficiently bringing a mortgage it gets necessary for regularly check into your residence loan statements. Expertise your HDFC Home loan statement on the net is essential for managing your money effortlessly. It provides an in depth review of your repayments, showcasing how much cash of one’s installment goes on dominating count and exactly how far talks about the attention. It understanding is important to possess think income tax deductions and you can making sure your take advantage of out of your taxation experts as it among the finest benefits associated with getting home financing.

What is actually a keen HDFC Financial Report?

A keen HDFC Financial declaration try an extensive file you to definitely outlines the information of your loan, including the disbursement amount, rate of interest, repayment tenure, plus the summary of per EMI. It plays a critical part in assisting individuals song their financing progress and you will plan for income tax deductions effectively.

Before you take toward a home loan, the crucial thing you do a-deep diving into the costs and get a definite knowledge of dominating loan amount and interest repayments. A beneficial foresight in connection with this try calculating the monthly EMI’s to have ideal monetary think. Of these browsing place their houses into the lease may also listed below are some that’s book repaired around book handle work, getting wise decision-making.

Ensure Their Mobile getting Safer Availableness

To guarantee the shelter of your own economic pointers, it’s important to ensure your mobile count as part of the HDFC Financial statement accessibility process. This step functions as a secure, making sure just you can access your loan report on the internet. Immediately after verified, you get quick notifications and you can https://availableloan.net/loans/installment-loan-direct-lenders/ OTPs on your own inserted cellular, raising the safety of your on line financial sense.

The significance of Continuously Checking Your own HDFC Financial Report

Typical track of their HDFC Mortgage statement is extremely important to own being near the top of your money. It helps you realize the new fictional character of one’s financing cost, guaranteeing you’re usually conscious of new a great harmony together with improvements you’ve made towards the done installment. This vigilance is paramount to managing their taxation write-offs effortlessly, because makes you choose qualified deductions and you will bundle your own finances correctly.

How it Assists with Handling Your bank account

Remaining a near eye on your HDFC Mortgage report aids inside the top economic planning. By the understanding how your instalments try assigned between the principal and you will interest, you could make informed decisions regarding your loan prepayment or restructuring if needed. This knowledge are indispensable to own optimizing tax write-offs, because allows you to control the most you can benefits, thus lowering your nonexempt income.