Most useful Automotive loans Prices and you will Funding off 2024

A knowledgeable auto loan pricing and you may money of 2024 are gotten owing to creditors, and additionally PenFed Borrowing Partnership, People Borrowing from the bank Relationship, Electronic Federal Credit Commitment, and you will USAA

Debt’s writers are reporters, private financing positives, and you may formal borrowing from the bank advisors. Its advice for currency steps to make they, simple tips to save yourself it, and ways to invest it lies in, collectively, an effective century from personal funds sense. These are typically searched when you look at the mass media outlets anywhere between The newest York Times to help you Us Now, out-of Forbes so you can FOX Development, and you may out of MSN in order to CBS.

The LightStream, Alliant Borrowing Relationship, Navy Federal Borrowing from the bank Relationship, and you can MyAutoLoan are also creditors that will individuals score an enthusiastic car loan.

PenFed is actually a national borrowing from the bank union that is one of many greatest auto lenders and you can caters to an incredible number of users worldwide. PenFed’s automobile car finance prequalification is the best for borrowers which have a good good credit get. People Borrowing from the bank Union (CCU) offers individuals services, and you will co-signer or co-debtor options are available. Digital Government Borrowing Connection (DCU) is actually a member-had and you will affiliate-manage low-earnings financial cooperative providing more than one million participants and you may parents. DCU people are the best candidates to have DCU’s vehicles car finance.

The brand new Joined Characteristics Vehicles Relationship (USAA) is amongst the best lender having automobile financing. Its an american financial properties provider that gives financial and insurance policies products to help you veterans and energetic duty professionals. USAA also offers a variety of private.

LightStream was a western online lender that offers unsecured personal loans in order to individuals with good credit analysis. Alliant Borrowing from the bank Union is among the best spot to track down an auto loan because it is the greatest borrowing from the bank union for the Illinois and United states, offering superior pricing and a safe destination to spend less. The latest Navy Government Borrowing from the bank Commitment (NFCU) is actually a not-for-cash monetary collaborative you to provides army users and their household. MyAutoLoan are an on-line financing marketplaces you to connects customers which have numerous lenders compliment of an individual on the internet webpage.

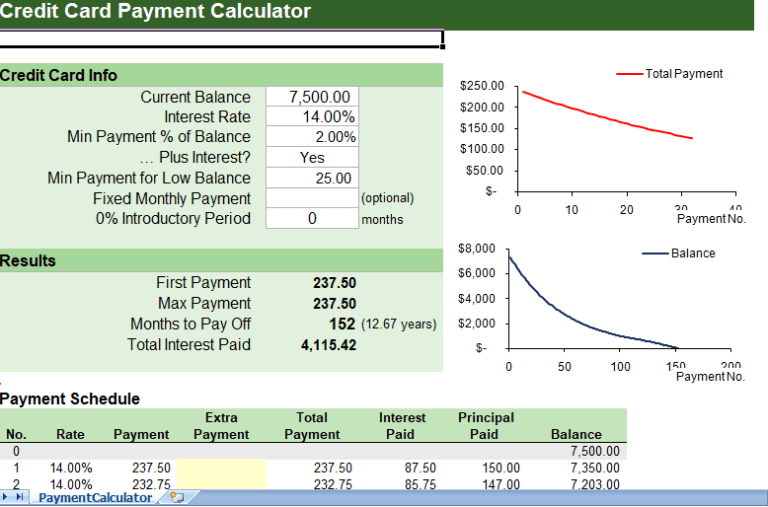

An auto loan was a protected financing option which enables customers so you’re able to borrow money away from a loan provider to buy a vehicle otherwise almost every other car. A premier credit rating qualifies for a reduced interest, saving money. The borrowed funds conditions were interest rate, annual percentage rate (APR), advance payment, payment per month, mortgage label, principal, and you will total mortgage costs. Understanding the paydayloanalabama.com/foley terminology facilitate debtors select the right choice for the auto buy.

The mortgage is repaid during the fixed payments more a flat months, that have interest charged towards borrowed money

An educated automotive loans offer masters such as for example and also make automobile control obtainable, improving credit ratings, and you will making it possible for less costs over the years. Automotive loans are susceptible to getting expensive, causing repossession and you may decline over the years. Car finance costs derive from items such credit rating, financing duration, vehicles form of, and you may financial. Increased credit rating leads to down auto interest rates now, reflecting a diminished risk to lenders. An auto loan calculator helps borrowers compare even offers and select one of a knowledgeable car loan businesses that match the financial situation.

Finest auto loans are acquired compliment of finance companies, credit unions, on the web lenders, provider financing, peer-to-peer financing, and authoritative car loan providers. Financial obligation are a company that give auto loan guidance as a result of certified monetary counselors to help people create debt, increase credit and budget, and you can rescue for long-identity requirements.This new table below suggests an informed equity loan lenders for the 2024, for instance the projected ount, and you may minimal credit history called for. The lenders are recognized for acquiring the finest car loans interest rates now, permitting consumers choose that loan that suits the budget, qualification, and you can financial position.