Conforming and you can FHA Loan Restrictions by County

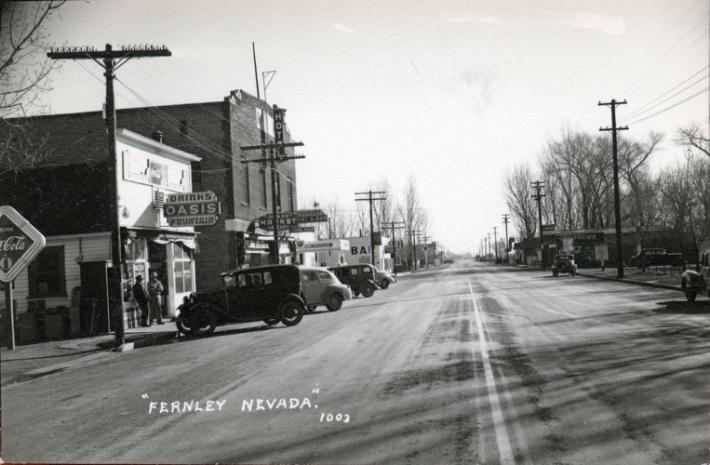

Post on Kansas Mortgages

It true heartland condition has plenty provide, of broad, unlock prairie and you will grain sphere in order to Hutchinson’s Cosmosphere and you may Room Heart, also Wichita’s aviation previous. Regarding a home, you will find that Kansas mortgage cost is over the national mediocre, even in the event they usually have historically come below they.

Federal Mortgage Cost

- Ohio possessions taxation

- Ohio later years fees

- Kansas income tax calculator

- Learn more about home loan costs

- How much household can you pay for

- Calculate monthly mortgage repayments

- Infographic: Ideal cities to acquire a home loan

Ohio Mortgages Evaluation

It’s regular to see straight down home prices on Midwest, and you will Ohio is not any exception to this rule. The fresh new average household worthy of is actually $183,800, since national average was $281,eight hundred.

Ohio have lenient disclosure guidelines to own sellers versus other individuals of the nation. If you find yourself in search of a property into the Kansas, its vital you to buyers feel vigilant when considering a house get. A knowledgeable move to make is to program a house assessment having a properly-top inspector otherwise company. This will protect you from to get property that disastrous defects.

30-Year Fixed Mortgage Prices in the Ohio

Fixed-rate mortgages is the popular type of home loans. Rates of interest one to are still a comparable during the course of the fresh new mortgage make it easier to plan for monthly obligations. That implies you know just what you are getting with the whenever your indication the loan plus monthly premiums will remain regular over the years. The most famous was 30-seasons repaired-speed mortgages and that are apt to have higher interest levels but down monthly obligations. An alternative choice is actually good 15-12 months financing. Such tend to have down interest rates but large repayments.

Ohio Jumbo Mortgage Prices

Home on the state’s bread-basket are cheaper than just the common American home, so the conforming loan limitation ‘s the important $726,200 round the the areas. If you want to sign up for a bigger financing you to definitely than simply with the household you have their attention on the, there’ll be what exactly is experienced a jumbo financing. Keep in mind that jumbo finance have high interest rates. Giving that loan which is larger than this new conforming financing maximum gifts a bigger exposure having loan providers. Finance companies mount high rates of interest so you’re able to jumbo financing in an effort to compensate toward more exposure. Although not, jumbo financing mediocre into the Kansas are already lower right now.

Kansas Sleeve Financing Prices

A variable-speed financial (ARM) was a loan you to generally speaking also provides a reduced interest upwards side than simply a fixed-speed mortgage. The reduced rate is obtainable having a time period of that, about three, four, 7 or ten years. Immediately following that period is over, the rate will increase one time per year. There are certain inspections in place, however, to get rid of customers exactly who choose Fingers of suddenly getting up to an exorbitant rate of interest. The new loan’s terms usually identify how often the speed can go up-and maximum you are able to height that it could visited. It’s very important to evaluate one interest limit and work out sure its you to definitely you can afford to invest prior to you decide you to a supply is the better choice for you. Strangely enough, Case prices are presently more than their fixed counterparts.

Kansas Home loan Resources

If you like guidance to get property regarding the Sunflower State, the new Ohio Casing Info Company enjoys forgivable fund having basic-time homebuyers to reduce away-of-pocket expenses associated with to purchase a home. While you are a resident, it’s also possible to weatherize your residence for more productive heating and air conditioning on the weatherization guidelines program. To have buyers who don’t be eligible for government housing guidance, brand new Reasonable Earnings Property program helps you supply loans and you will features.

First-go out home owners may also located help from the new Kansas Homes Direction Program. After you pick a house, to order can cost you adds up quick. However if you may be purchasing your earliest house and you are eligible, you can buy around 4% debtor bucks having a down payment and you will closing costs with this particular system. They also provide endless funding and you may 29-12 months repaired-rate loans with high loan-to-worthy of loans, very regardless of where inside the Kansas you want to, this is an effective funding for those simply starting out.

Available Resources

The united states Service regarding Farming Rural Innovation system also provides mortgage assist and you may mortgage gives from the whole country. The application form aims to help create so much more outlying aspects of a beneficial condition and provides safe, sensible construction having customers. Kansas enjoys provides and loans available for domestic repairs too due to the fact mortgage guidelines applications for those who be considered.

Ohio Financial Fees

Residents are allowed to deduct the loan interest they shell out whenever they document their federal taxes. So it can be applied to own Kansas county taxes also. You can double on your own deductions on the qualifying home loan appeal repayments you made on income tax 12 months by the also them into the one another federal and state filings. Kansas basically pursue federal direction to have itemized deductions.

From inside the earlier in the day years, Kansas energized a good 0.26% snap the link now mortgage fee on the a home purchases, but that’s no further your situation by . A plus getting Kansas buyers and you may providers, which condition will not fees fees on the property name transfers, you need not pay a payment for one.

Kansas Home loan Re-finance

If it’s time for you re-finance, you really have several choice. Your house Reasonable Re-finance Program (HARP) is no longer readily available, however, Federal national mortgage association already also provides its option, getting being qualified people entry to attract and dominant fee decreases because the really as reasonable settlement costs.

Otherwise qualify for possibly of these, think about you usually have the choice working toward financial which awarded your existing mortgage and you will researching refinance rates together with other loan providers to make sure you residential property on the a simple solution that really works for your role.