Would I be eligible for a good HARP mortgage?

What exactly is HARP?

HARP are a government step to help individuals who owe a lot more on the home as compared to residence is well worth-put differently, those who are under water on the financial. It signifies Household Sensible Re-finance System, and it is run from the Government Housing Fund Agencies (FHFA).

Why HARP?

Shortly after construction pricing crashed within the 2008, of a lot People in the us located by themselves with a substantial financial and you will a great depreciated home. Mortgage rates of interest dropped, however, loan providers was reluctant to re-finance underwater mortgage loans, thus such unlucky everyone failed to benefit from the lower cost to chop its monthly payments. Following, within the , government entities moved within the and you can created HARP, commonly known colloquially once the Obama re-finance program.

An excellent HARP refinance lets qualified home owners so you’re able to refinance even when they are obligated to pay more their house is worth. Usually, lenders wouldn’t re-finance underwater mortgages. But with HARP, the government gave Federal national mortgage association and Freddie Mac the fresh new go-in the future to back refinancing away from underwater mortgages and offer aggressive pricing. When you have used the program, it offers meant down homes will cost you and you will greater satisfaction.

Tunes great, but just who qualifies?

- He is current on their home loan.

- Their house are a first home, 1-unit second domestic, otherwise 1-to-cuatro unit investment property.

- They got their mortgage toward or ahead of .

- Their mortgage loans are supported by Federal national mortgage association or Freddie Mac.

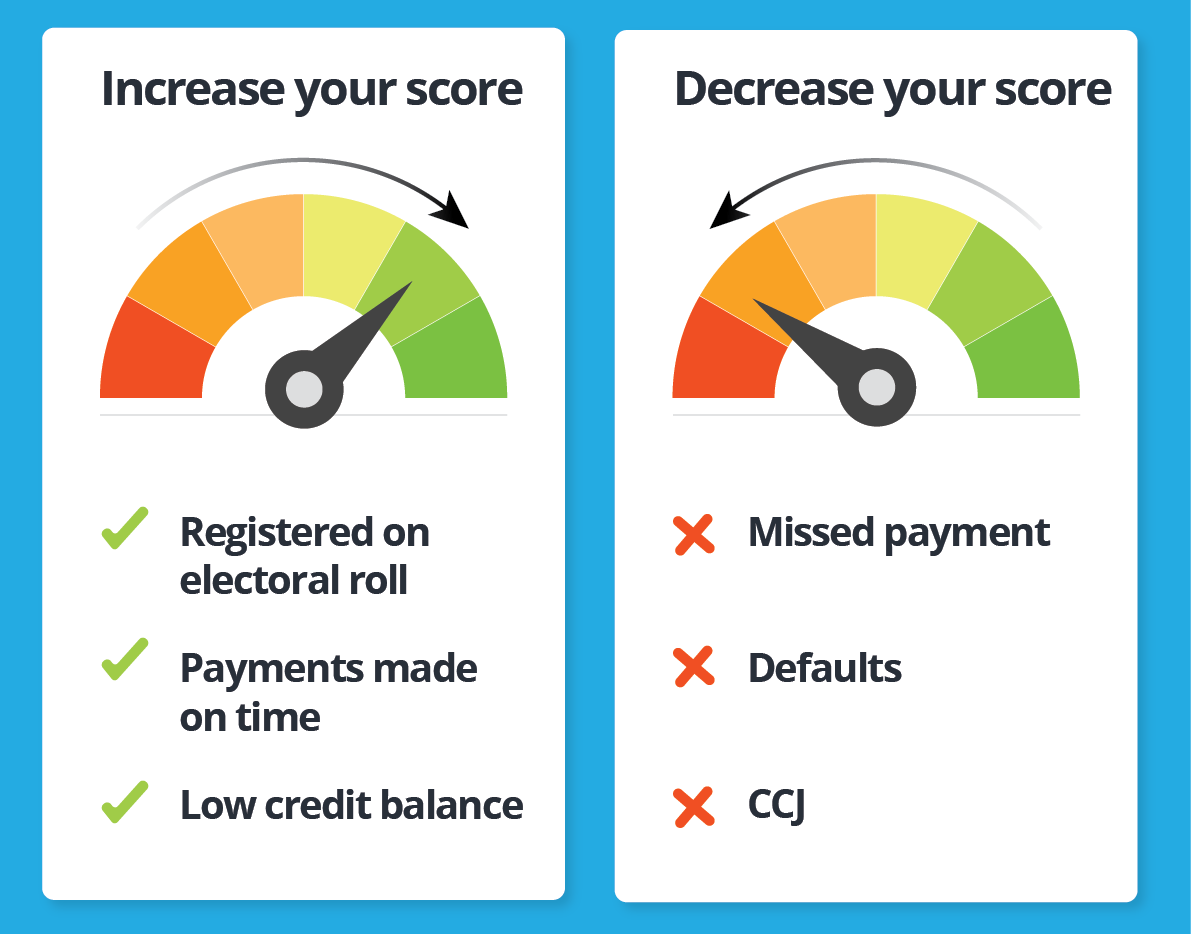

- He has that loan-to-value ratio from 80+% to your domestic.

What exactly is financing-to-value proportion?

In order to calculate the loan-to-value ratio (LTV) on your own home, separate the brand new a fantastic balance on your home loan by newest worth in your home, upcoming multiply by the 100 to obtain a percentage. If this commission is 80 or maybe more, you happen to be eligible for an excellent HARP financial, and in case you meet up with the most other criteria.

What is the difference in a mortgage servicer and you may a mortgage backer?

A beneficial matter! Plenty of people mistakenly imagine they will not be eligible for HARP due to the fact they will not send its month-to-month mortgage checks so you’re able to Fannie mae otherwise Freddie Mac. Instead, they upload their inspections to a regular lender. The bank you manage actually will be your financial servicer, but it is possible that either Federal national mortgage association or Freddie Mac computer are your own home loan backer, meaning that will ultimately your financial try repackaged and you can handed out to all of them. You should check online having both Fannie and you can Freddie to obtain away if they right back their financial.

Just how many some body qualify for an excellent HARP mortgage?

It’s estimated that no less than five hundred,000 homeowners-and possibly up to 2 mil-qualify for HARP but have not cheated the application form yet ,. Should this be your, act quickly so that you you should never get-off cash on the brand new desk! Because you really have lower or no guarantee does not always mean you are unable to re-finance.

We read one to HARP is ending soon?

- 30 year Repaired 30yr Fixed

- 15 year Repaired 15yr Fixed

- 5/1 Sleeve 5/1ARM

Is HARP too-good to be real?

This really is a costly error. When you’re underwater in your home loan, HARP may sound too good is felt, however, accept it as true. Then submit an application for it. Right after which intimate on your own HARP financial before avoid out of 2016. Remember, though, which you yourself can still need to spend settlement costs which have good HARP re-finance, so compare the newest deals on your monthly obligations to that costs. Should you decide into moving in the future, it may not become worthwhile to help you re-finance.

What’s the difference between HARP and you can a typical re-finance?

The most obvious difference between HARP and you may a frequent re-finance lays with brand new eligibility conditions. HARP was designed to get the new slack left from the lenders’ unwillingness to allow people with highest-LTV land refinance. Otherwise be eligible for a regular refinance, you may also qualify for HARP.

Another important huge difference would be the fact there isn’t any cash-out alternative having HARP. Which have a conventional re-finance, consumers often have the choice to obtain a somewhat larger home loan and cash-out the essential difference between the borrowed funds and whatever they very owe. They are able to use the cash to settle almost every other expense. HARP mortgages dont have this one.

Can i you want mortgage insurance policies?

For many who spend financial insurance rates towards financial for the established mortgage, just be sure to afford the same insurance fees after good HARP home loan re-finance. But if you you should never pay money for financial insurance coverage now, HARP would not require that you obtain it.

Can you imagine Really don’t such my lender?

No hassle. When you refinance through the HARP system you don’t need to utilize the exact same bank just who hooked your with the totally new financial.

The servicers having loans had otherwise secured by the Federal national mortgage association or Freddie Mac are required to participate in HARP, therefore you should has actually many solutions close by in the event the you decide to pursue good re-finance through another type of financial.

Exactly what documentation can i need to also provide with my app?

The paperwork you ought to have depends upon whether or not your work with similar lender otherwise another financial, as well as on anyone criteria of one’s bank. The fundamental documentation to put together is your mortgage comments (and those people getting the next financial when you yourself have one to), plus money information (paystubs and tax efficiency).

What if I am not saying current on my mortgage payments?

If you https://www.availableloan.net/installment-loans-or/ontario/ don’t have the percentage number to be eligible for HARP, was HAMP, the house Sensible Amendment Program. Instance HARP, HAMP falls under the brand new government’s And then make Domestic Reasonable system. As opposed to HARP, HAMP can be obtained to people that have dropped trailing to their mortgage payments because of pecuniary hardship. A number of financial servicers be involved in HAMP also HARP, therefore contact your financial if you feel HAMP ‘s the proper complement you.

We removed a HARP mortgage and you will is actually refused. So what now?

Its smart to look up to. Underneath the umbrella of HARP program, individual loan providers are permitted making variations for the qualifications conditions. For example, a loan provider you will decide it wishes a higher credit history than HARP assistance allow it to be, or which won’t take on loan providers that have instance large LTVs. Banking institutions may use their discernment to modify criteria before providing homeowners re-finance.

In the event that at first that you do not make it, are, try once more. Even though one financial does not want to assist you towards an excellent HARP financial re-finance does not always mean you’ll not have ideal fortune that have an alternate lender, credit partnership otherwise mortgage company. Web sites for Fannie mae and you can Freddie Mac features devices you should use to look right up HARP loan providers towards you. Shop around on the lowest HARP financial price discover having a lender that is ready to assist you.