This type of criteria assist loan providers assess what you can do to settle the mortgage responsibly

express so it:

Unlocking the potential of your house’s collateral compliment of a house Guarantee Credit line (HELOC) offer residents with monetary freedom. A HELOC is different from a timeless domestic security loan by offering good rotating personal line of credit, allowing you to borrow money as needed up to your acknowledged restriction. Knowing the HELOC software processes, also eligibility conditions additionally the draw and cost attacks, is essential in making informed financial decisions.

Qualifying to possess an effective HELOC: Trick Standards

To get recognition having a good HELOC, loan providers usually imagine numerous affairs, along with simply how much security you really have of your property, your credit rating, and your personal debt-to-earnings ratio.

Sufficient Household Guarantee

So you’re able to be eligible for a beneficial HELOC, property owners need to have sufficient collateral within possessions. Security is the difference between the home’s current market worthy of and you will the an excellent financial harmony. Such as, if for example the home is valued at $300,000 and you have home financing harmony away from $150,000, your home guarantee was $150,000. Lenders normally need borrowers getting no less than fifteen20% equity just before granting an excellent HELOC software. It means the mortgage equilibrium will be 8085% otherwise a reduced amount of your house’s well worth.

Credible Money

Loan providers wanted evidence of uniform income to make certain you might would the extra monthly installments of the an excellent HELOC. So you’re able to qualify, you might have to bring records such:

- Work earnings. W-2 mode, lender comments, and you https://paydayloanalabama.com/putnam/ can current shell out stubs

- Self-work earnings. Tax returns and you will money losings statements

- Later years income. Social Defense comments, your retirement, or annuity suggestions

- Other income present. Papers for even more income, such as for example local rental property income otherwise capital production

Solid Creditworthiness

A robust credit history and you may responsible credit administration are very important to possess HELOC recognition. Loan providers cautiously determine the creditworthiness to determine your loan eligibility. A credit rating typically a lot more than 680, coupled with an everyday reputation of to your-big date payments, shows debt precision. Building and keeping an effective borrowing from the bank profile helps you safe positive HELOC words.

Reduced Debt-to-Earnings Proportion

Your debt-to-money (DTI) proportion measures your own monthly loans payments (credit cards, auto loans, etc.) in line with your revenue. Loan providers explore DTI to evaluate what you can do to deal with extra economic financial obligation. A lower life expectancy DTI, normally below 43%, basically advances your chances of HELOC recognition. To change your own DTI, consider paying down existing financial obligation, expanding earnings, or refinancing high-notice money.

Insights HELOC Draw and you can Repayment Attacks

An effective HELOC operates in 2 phases: the latest draw several months therefore the payment months. When you look at the mark period, generally speaking lasting from around 5 so you’re able to a decade, you can access financing as needed, doing your own borrowing limit. You might be fundamentally forced to make notice-merely repayments during this period, many financial institutions can also need repayments to your the main. As mark period closes, the fresh payment months begins, and you’ll make one another dominant and you can notice money. The size of this phase may vary by the bank, but could work at any where from 5 to help you 2 decades.

Ideas on how to Make an application for an excellent HELOC

Securing a house Collateral Line of credit involves several procedures. By the skills such tips, you could navigate the HELOC software procedure to make informed conclusion.

step one | Collect needed files

So you’re able to initiate the fresh new HELOC app, collect very important documents particularly proof income (pay stubs, tax statements), homeownership confirmation (property goverment tax bill, home loan declaration), and personality. Which have these data available will improve the applying process.

dos | Finish the application

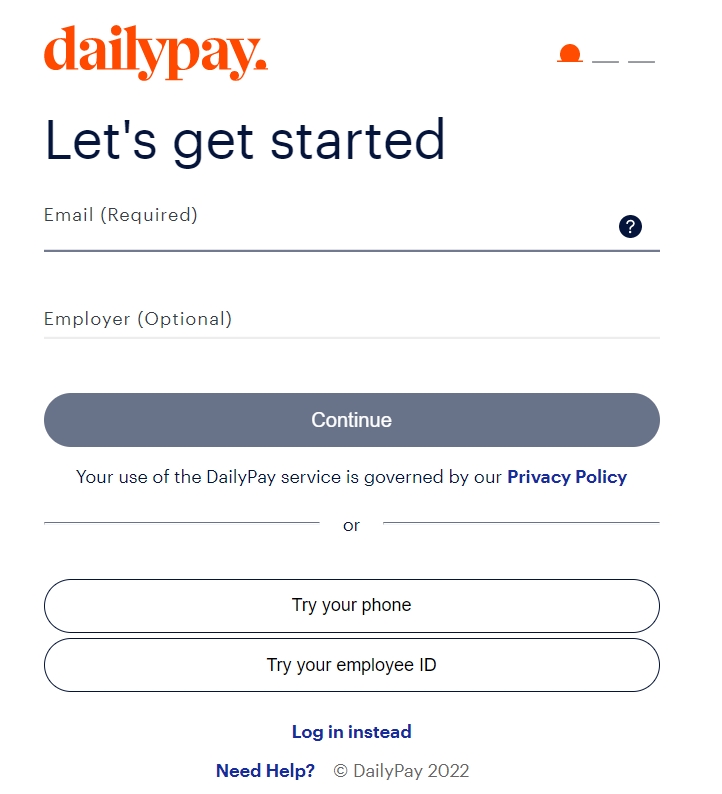

Extremely financial institutions offer on line applications to possess benefits, even though some financial institutions and borrowing unions choose your incorporate in the-person on a neighborhood department. Anticipate to render more information regarding the financial predicament, assets, and you may need HELOC conditions.

step three | Wait from underwriting procedure

Lenders often remark the application, evaluate your creditworthiness, and ensure your revenue and you can value of. This step cover anything from property assessment to decide their house’s market worth.

4 | Close into the HELOC

Up on acceptance, you’ll get that loan contract outlining the fresh new terms and conditions. You will need to sign the mortgage agreement and you may spend any closing will set you back, if the relevant. A brief waiting months, usually a short while, makes you feedback new conditions until the financing becomes productive.

5 | Supply Their HELOC

After the closing processes, it is possible to gain access to the HELOC fund. It constantly concerns choosing good checkbook to have distributions, however some loan providers allow you to import the amount of money into your personal family savings.

Ready to open the potential of their residence’s equity? Traditions Friends Credit Relationship also provides aggressive HELOC possibilities customized toward needs. Our very own educated lenders was here to guide you through the techniques which help you make told choices. Contact us right now to learn more and begin the HELOC journey.