Factors to consider Before Playing with A house Guarantee Mortgage Getting A good Automobile Buy

Head resource concerns a loan provider and you can borrower instead a distributor. Its supplied by on the web loan providers, banking companies, and you may credit unions. Getting capital before you go to help you a car dealership is recommended.

Precomputed Attention Finance

A beneficial pre-determined notice financing possess a fixed rate of interest and you can monthly payment. The attention and you will origination charge is determined beforehand and split over the financing name. In the event that money commonly produced promptly, the lender will reduce the principal to afford charges.

New month-to-month payments into a precomputed attention loan are going to be straight down than just for the a straightforward interest mortgage, but there is zero prize having paying the mortgage very early.

Safeguarded Auto loans

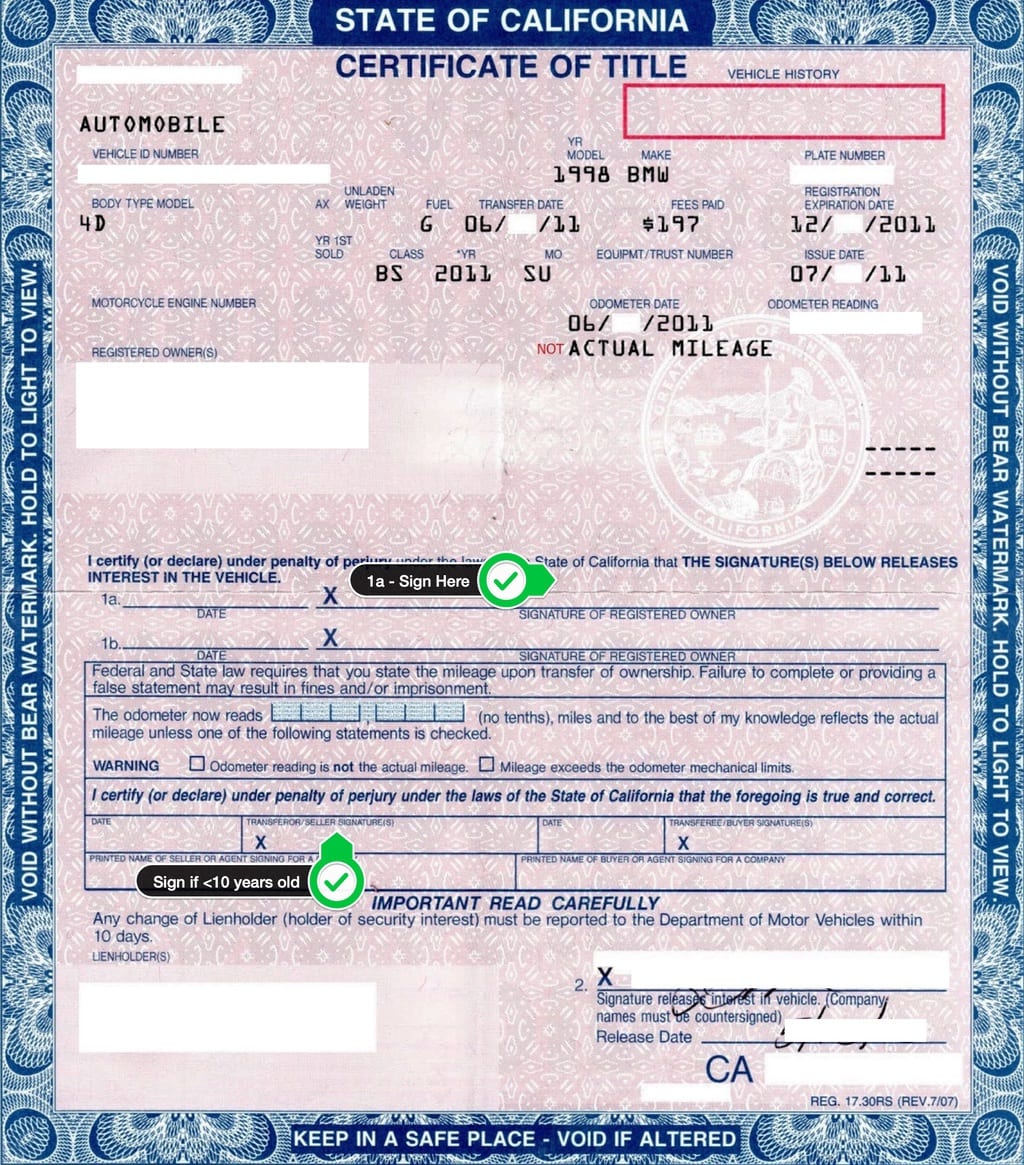

A secured loan is a kind of financing that needs you to help you hope a valuable asset, just like your automobile, while the security. It indicates the lending company has a right when deciding to take hands of vehicles for folks who default for the payments.

To help you secure the financing, you need to let them have an excellent lien on your own car’s identity and you can could only transfer possession of auto as the financing was completely paid back. They may repossess the car to recoup the losings if you can’t build repayments.

Easy Desire Loans

A simple appeal financing functions in this way: the payment is determined by the rate, the mortgage equilibrium, therefore the notice you’ve accrued since you history reduced. Most of your commission would go to attract; others can be used to expend the primary. It is possible to make way more money to repay the mortgage quicker and you may spend less on focus.

Conventional Auto loan

Traditional automobile financing are available for one another the newest and you will utilized cars. The speed for brand new vehicles is lower, when you’re pricing to have old vehicles are highest. Even a car or truck just one day old is considered old of these fund, and specialized pre-owned automobile.

Unsecured loans

Signature loans, eg handmade cards, personal loans, personal lines of credit, and you will student education loans, aren’t linked to any asset that is certainly repossessed. You can find couple limitations so you’re able to the way the currency can be used.

When selecting a car using property equity mortgage, you can find five affairs it is best to thought this is how are a summary of all loans Grant of them.

Simply how much Collateral Is during Your home?

The worth of your home security ‘s the difference between the fresh worth of your home and you will your balance. Such, when your house is really worth $five-hundred,000 and you owe $400,000, your guarantee are $100,000.

The greater collateral you have got, the more you could potentially borrow. Usually, lenders provide simply part of your house, if you reduce than just ten% guarantee, it can be difficult to get a competitive loan rate.

What will The whole process of Obtaining Loan Involve?

Taking a property security financing is going to be tricky. You may need to also provide so much more economic information than for most other loans. This includes your earnings and you will a credit score assessment.

How much Are the Settlement costs On the Mortgage?

Some loan providers offer household security finance and no closing costs. Although not, you’re charged a top rate of interest or finance closing expenditures as part of the mortgage.

Such will set you back ranges anywhere between dos% and you will 5% of your mortgage complete. Which large commission might be a weight when credit.

Tend to The Attract Be Tax deductible?

Domestic security finance would be a tax-effective way so you’re able to borrow funds if you meet the prerequisites. If you use the mortgage continues to construct otherwise increase up on your primary house, up coming one focus reduced for the financing was tax deductible. You might cut back to twenty-two% of loan’s desire can cost you in your taxes.