How much time Does Virtual assistant Mortgage Pre-Acceptance Grab

The length of time Really does https://paydayloanalabama.com/snead/ Virtual assistant Financing Pre-Acceptance Grab

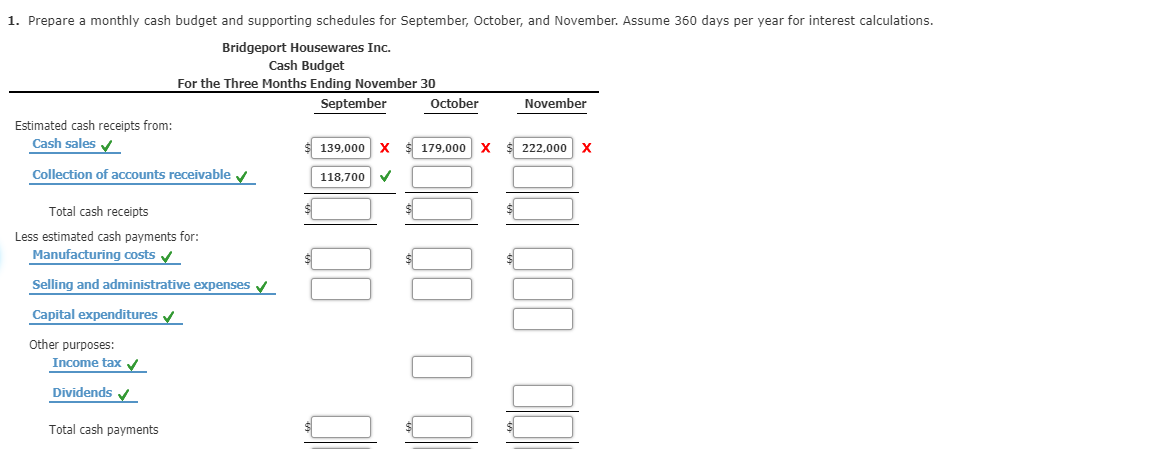

Are you considering trying to get an effective Va loan? If so, you will be wanting to know how much time it will require locate pre-recognized. Of numerous potential homebuyers was surprised to acquire that Va mortgage procedure is relatively quick and simple compared to most old-fashioned mortgages.

The fresh Virtual assistant mortgage program is an excellent choice for of a lot veterans and you will energetic armed forces team who want to get a home. It’s got some of the best conditions available when comparing to other sorts of mortgage loans, along with zero down-payment requirement and low-rates of interest. Before you could start wanting your ideal household, you will need to make sure you are pre-recognized to the financing.

Providing pre-approved does not grab so long as you might think, however, there are numerous procedures mixed up in techniques. Regarding get together your financial data in order to submission all of them getting comment and you will taking an endorsement page, there’s a lot that really must be done to get pre-recognized getting an effective Va mortgage.

What’s Virtual assistant Financing Pre-Acceptance?

Va financing pre-approval was a process that allows experts and productive military professionals so you’re able to secure a great Va loan for purchasing a property . This mortgage was supported by this new U.S. Agency of Experts Things , which makes it easier for pros in order to qualify for home loan investment having a great deal more favorable conditions than just conventional mortgage loans. The fresh pre-approval procedure pertains to submitting recommendations like your money and you can credit rating, as well as other files, for the bank so they can feedback the eligibility with the loan.

The fresh new pre-acceptance process may take anywhere from a couple of days to numerous days with regards to the lender’s criteria plus types of finances. For example, if you have a lower credit history or higher loans-to-money proportion, it may take prolonged to locate acceptance than simply for those who have higher level credit and you will a reduced obligations-to-earnings ratio. Likewise, certain lenders might need extra documentation or verification of the suggestions ahead of they accept the mortgage. Providing date beforehand to set up all papers will help automate this action and have now you nearer to buying your ideal family smaller.

What makes Virtual assistant Loan Pre-Recognition Extremely important?

Va financing pre-approval is an important action to possess pros and you may effective armed forces teams looking to purchase a house. It not merely helps them know if it be eligible for a good Va loan plus gives them the ability to secure resource with additional positive terms than simply antique mortgage loans. Pre-approval also lets consumers to make an aggressive offer on the chosen family, because the sellers know the customer had been acknowledged into loan.

- provides quality concerning your financial predicament before buying a house.

- tells you exactly how much you can afford and you may which one from mortgage repayments we offer.

- makes it easier evaluate other lenders and acquire the best financial price.

- will help strengthen your bring when making an offer on the wished assets

- also offers significantly more beneficial terms than conventional mortgage loans, including no down-payment requirement minimizing closing costs.

Pre-recognition is an essential starting point undergoing to buy a house with a beneficial Va financing, and you will potentially saving several thousand dollars ultimately. Bringing big date in advance to gather all the required documents and you will information will help automate this course of action so that you can begin wanting your dream home sooner or later.

The length of time Will it Shot Rating Virtual assistant Loan Pre-Approval?

Immediately following the expected data and you will advice was in fact attained, it is the right time to initiate the newest Va mortgage pre-approval process. This action usually takes ranging from a couple and you can a month , according to bank . During this time period, the lending company will review the money you owe and you may credit rating in order to determine if youre qualified to receive a great Va loan. They might also need a lot more paperwork otherwise confirmation of a few off every piece of information considering.